How Do I Navigate Customs When Importing Furniture From China?

May 3, 2025 •

Importing furniture from China can save you thousands, but getting caught in customs limbo is costly and frustrating. Many importers face delays, unexpected fees, and even seizures because they didn't know the rules.

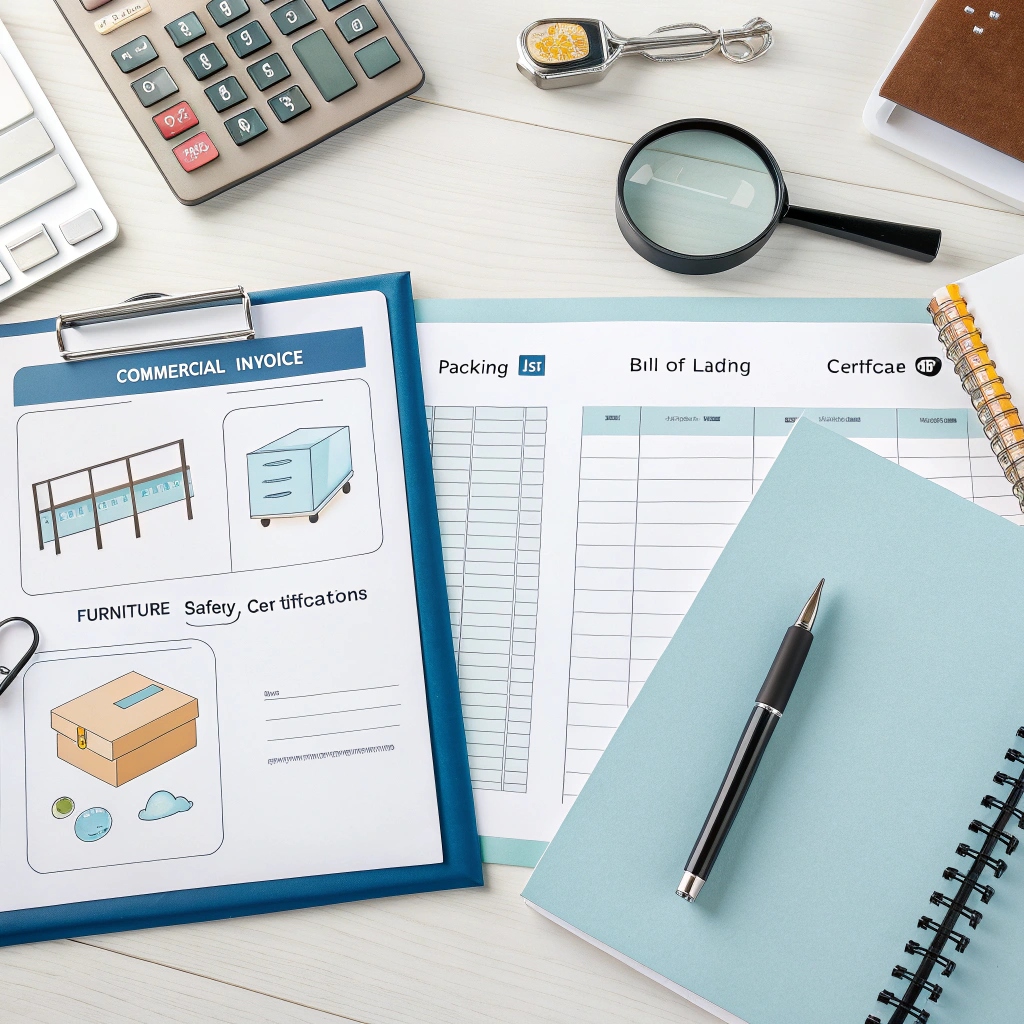

To successfully navigate customs when importing furniture from China, you need proper documentation (commercial invoice, packing list, bill of lading), correct HS codes, compliance with safety standards, and awareness of duties and taxes. Working with a customs broker is highly recommended for first-time importers.

I remember my first furniture import—a container of office chairs that sat at the port for three weeks because I missed some paperwork. That expensive lesson taught me that customs clearance isn't something you can wing. Let me walk you through what you need to know to avoid similar headaches.

What Documentation Do I Need for Furniture Imports?

The fear of having your shipment stuck at customs is real. Many importers lose thousands because they didn't prepare the right paperwork, leading to storage fees and missed sales opportunities.

Essential documentation for furniture imports includes a commercial invoice with detailed product descriptions and values, a packing list, bill of lading or airway bill, certificate of origin, and product-specific certifications like TSCA for wooden furniture or flammability standards for upholstered pieces.

Documentation is the backbone of smooth customs clearance. I've seen too many clients try to cut corners here, only to pay much more in the end. Let's break down what each document needs to include:

Key Documentation Requirements

| Document | Required Content | Common Mistakes |

|---|---|---|

| Commercial Invoice | Detailed description of goods, HS codes, quantity, unit price, total value, country of origin | Vague descriptions, missing HS codes, incorrect valuation |

| Packing List | Item count, dimensions, weights, packaging details | Discrepancies with actual shipment, incomplete information |

| Bill of Lading | Shipper/consignee info, vessel details, container numbers | Incorrect consignee information, missing notify party |

| Certificate of Origin | Declaration of where products were manufactured | Not getting it authenticated, incorrect manufacturing details |

I've developed a pre-shipment checklist that I share with my suppliers in China to ensure nothing gets missed. The key is to start preparing these documents well before your furniture leaves the factory. Don't wait until the shipment is on the water—by then, it's often too late to correct mistakes that could hold up your goods.

How Do I Determine the Correct HS Codes and Duties for My Furniture?

Picking wrong HS codes1 has cost importers thousands in penalties. One client paid 15% more in duties2 because they misclassified their wooden bedroom furniture, turning what should've been a profitable order into a break-even situation.

To determine correct HS codes for furniture imports, consult the Harmonized Tariff Schedule (Chapter 94 for most furniture). Wooden furniture typically falls under 9403.50-9403.60, upholstered under 9401.61-9401.71. Duties range from 0-7.5% for most items but can reach 25% for Chinese furniture under Section 301 tariffs.

HS code classification is both an art and a science. When I first started importing, I was shocked by how specific these codes get—there are different classifications for wooden kitchen furniture versus wooden bedroom furniture, and metal furniture has its own categories entirely.

Understanding Furniture Duty Rates

| Furniture Type | Typical HS Code | Basic Duty Rate | Additional China Tariffs |

|---|---|---|---|

| Wooden Bedroom | 9403.50 | 0% | +25% (Section 301) |

| Wooden Kitchen | 9403.40 | 0% | +25% (Section 301) |

| Metal Office | 9403.10 | 0% | +25% (Section 301) |

| Upholstered Seating | 9401.61 | 0% | +25% (Section 301) |

| Plastic Furniture | 9403.70 | 0% | +25% (Section 301) |

Beyond the base duty rates, you need to factor in additional costs like Merchandise Processing Fee (0.3464% with a minimum of $27.23 and maximum of $528.33) and Harbor Maintenance Fee (0.125% of value). I always advise my clients to build at least a 30% buffer into their pricing to account for all these customs-related costs.

The Section 301 tariffs on Chinese goods have dramatically changed the economics of furniture importing. I've helped several clients explore partial assembly strategies or look at alternative sourcing countries like Vietnam or Malaysia to mitigate these costs.

What Compliance Standards Must My Imported Furniture Meet?

Ignoring compliance standards is a costly mistake. One of my customers had an entire container of children's furniture rejected because it contained excessive levels of formaldehyde. The financial hit was devastating—$45,000 in product value plus shipping costs, all lost.

Imported furniture must comply with various standards including TSCA Title VI (formaldehyde emissions for composite wood), CPSC flammability standards for upholstered furniture, CPSIA requirements for children's furniture, California Proposition 65, and proper labeling with country of origin and materials used.

Compliance isn't optional—it's a legal requirement that customs takes very seriously. After years in this industry, I've developed a systematic approach to ensuring all furniture imports meet necessary standards.

Essential Compliance Requirements by Furniture Type

| Furniture Category | Key Regulations | Required Testing/Documents |

|---|---|---|

| Wooden Furniture | TSCA Title VI, Lacey Act | Formaldehyde emission test reports, wood sourcing documentation |

| Upholstered Items | 16 CFR Part 1632/1633, CA TB 117-2013 | Flammability test certificates, flame retardant disclosures |

| Children's Furniture | CPSIA, 16 CFR 1303 | Lead testing certificates, tracking labels, stability testing |

| All Furniture | Country of Origin Marking | Permanent, visible labeling |

I've found that the best approach is to request compliance documentation early in your sourcing process, not as an afterthought. Include specific compliance requirements in your purchase contracts with Chinese suppliers and verify through third-party testing when needed. For wooden furniture especially, I recommend working with factories that already export to the US and understand TSCA requirements.

The penalties for non-compliance can include denied entry, mandatory re-exportation (at your expense), fines, and even potential legal liability if unsafe products reach consumers. I now build compliance verification into every stage of my import process, from supplier selection to pre-shipment inspection.

Should I Hire a Customs Broker for My Furniture Imports?

I once tried to handle customs clearance myself to save a few hundred dollars. The result? A two-week delay, storage fees, and eventually hiring a broker anyway to untangle the mess. That "savings" cost me over $3,000 in the end.

Yes, hiring a customs broker is highly recommended for furniture imports, especially for beginners. Brokers typically charge $250-500 per shipment but save you money by preventing costly mistakes, ensuring proper classification, managing documentation, and navigating complex regulations like antidumping duties.

Working with a customs broker has been one of the best business decisions I've made in my importing journey. They do far more than just file paperwork—they're your guide through the complex world of customs regulations.

What to Look for in a Customs Broker

| Consideration | Why It Matters | Questions to Ask |

|---|---|---|

| Furniture Experience | Industry-specific knowledge | "What percentage of your business is furniture imports?" |

| Geographic Coverage | Port-specific expertise | "Do you have offices/agents at all ports where my shipments might arrive?" |

| Technology | Efficiency and tracking | "What systems do you use for document submission and shipment tracking?" |

| Services Offered | Beyond basic entry filing | "Can you help with classification, compliance advice, and duty planning?" |

I recommend interviewing at least three brokers before making a decision. Ask for references from other furniture importers specifically. The relationship with your broker is crucial—they're essentially an extension of your business when it comes to customs matters.

While broker fees are an additional expense, I've found they typically pay for themselves by preventing just one customs problem. They can also help identify opportunities for duty savings through programs like first sale valuation or foreign trade zones that you might not be aware of.

Conclusion

Successfully navigating customs when importing furniture from China requires proper documentation, accurate HS codes, compliance with safety standards, and ideally, a good customs broker. Following these guidelines will help you avoid delays and unexpected costs.

You may also be interested in:

Looking for the Best Sofa Manufacturers in China?

Looking for the Best Sofa Manufacturers in China? leading paragraph: Finding reliable sofa manufacturers in China can be tough. With

Get in Touch

Have questions about our recycled PET packaging solutions? Contact LingGao today and discover how our sustainable products can elevate your brand.

Website

www.essaone.com

Location

ESSAVAN LLC:Russian Federation, 108811, Moscow, Moscow settlement, Kievskoye Highway, 22nd km (Moskovsky), building 4, structure 2, Block G, floor 6, office No. 605/1

Vladivostok warehouse: 690074, Primorsky Krai, Vladivostok, Pervorechensky District, Vyselkovaya Street, 54 “A”

Phone: 8-800-550-3301